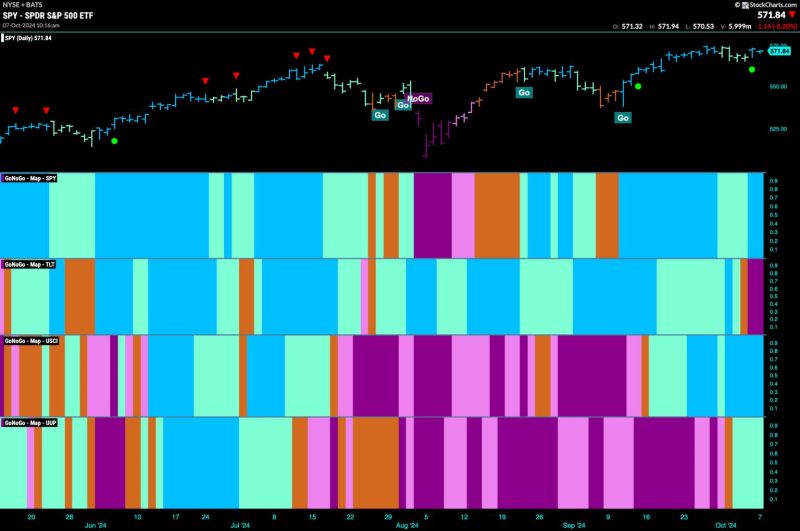

Good morning and welcome to this week’s Flight Path. Equities saw the trend remain and as the week came to a close we saw more strong blue “Go” bars as price rallied close to prior highs. GoNoGo Trend shows that there has been a change in trend from “Go” to “NoGo” for treasury bond prices. After an amber “Go Fish” bar we see strong purple “NoGo” bars. The U.S. commodity index remains in a strong “Go” trend this week while the dollar saw a “Go” take over albeit painting weaker aqua bars.

$SPY Fights to Stay Near Highs in “Go” Trend

The GoNoGo chart below shows that after several bars of weakness we see the bright blue bars of a stronger trend return. This may provide a new level of support as we move forward. We also see a Go Trend Continuation Icon (green circle) as GoNoGo Oscillator found support at the zero line. We see that after just one bar we are back testing that level again. It will be important for the oscillator to continue to find support at that level to provide a springboard for price to move higher from here.

The longer time frame chart shows us that GoNoGo Trend painted another strong blue “Go” bar this past week and on a closing basis we made a new high. GoNoGo Oscillator shows that momentum is positive but not yet overbought. We will watch to see if momentum remains at or above the zero line as price challenges for more gains.

New “Go” Trend For Treasury Yields

Treasury bond yields have climbed to new highs and we saw GoNoGo trend roll through the colors as a couple of amber “Go Fish” bars were followed by a first new “Go” bar for several months. GoNoGo Oscillator burst through the zero level last week and out of a GoNoGo Squeeze. Since then, it has retested and found support at zero and that tipped us off to the change in trend in the price panel above. We now see momentum at a value of 5 and so there is enthusiasm around this price move.

The Dollar Saw a “Go” Trend Emerge

Price climbed quickly this week and followed an amber “Go Fish” bar with a string of aqua “Go” bars as price climbed to new highs. GoNoGo Oscillator having struggled with the zero level for several bars assertively broke through into positive territory and we saw an increase in volume as the oscillator rose to a value of 5. Now we can say that momentum is on the side of the new “Go” trend as it tries to consolidate at these new levels.