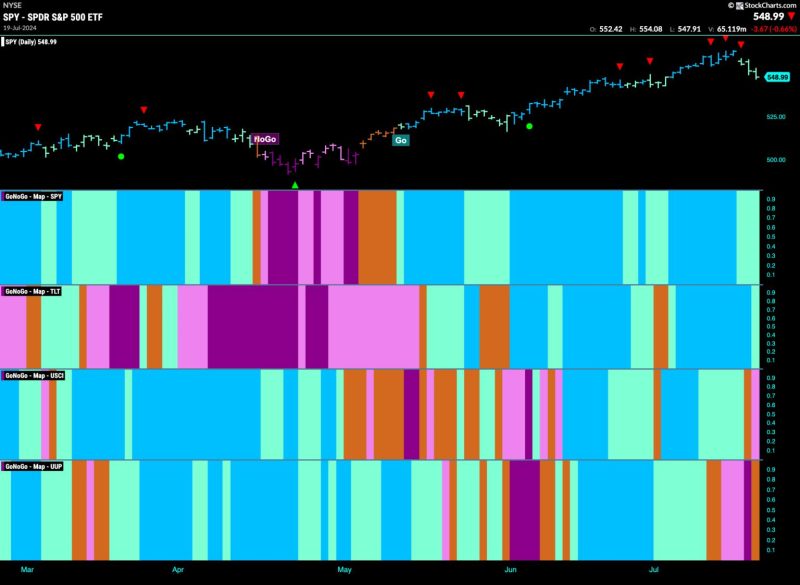

Good morning and welcome to this week’s Flight Path. We saw a lot of weakness this week but so far the “Go” trend has held in U.S. equities. GoNoGo Trend has reflected the weakness with a couple of aqua “Go” bars late in the week. Treasury bond prices showed a weaker aqua “Go” bar as well but remained in trend. The U.S. commodities index saw the “Go” trend crack and an amber “Go Fish” bar was followed by a pink “NoGo” trend bar. The dollar, having flirted with a “NoGo” all week, saw GoNoGo Trend paint an amber “Go Fish” bar on Friday.

$SPY Sees Price Fall From Highs

Last week we noted the Go Countertrend Correction Icons (red arrows) indicating that price may struggle to go higher in the short term. Indeed, we saw another red arrow early in the week before price really fell away. GoNoGo Trend has painted 3 consecutive weaker aqua bars. GoNoGo Oscillator has fallen sharply to test the zero level from above on heavy volume. It will be important for the Oscillator to hold the zero line if we are to prevent a deeper price drop. We are at an area that could offer price support from recent congestion levels and so this will be an important week.

Although we still see a strong blue “Go” bar this week on the longer time frame chart, it is a lower weekly close. We also see a Go Countertrend Correction Icon (red arrow) telling us that in the short term price may struggle to go higher. GoNoGo Oscillator shows that momentum has waned and it is in positive territory but no longer overbought.

Treasury Rates Remain in “NoGo” Trend

This week saw a new lower low for treasury bond rates on the daily chart. Strong purple “NoGo” bars dominated the chart until Friday when price gapped higher and GoNoGo Trend painted a weaker pink bar. GoNoGo Oscillator is in negative territory at a value of -2. We will look to see if a new lower high is set this week.

More Uncertainty for the Dollar

Last week we talked about the uncertainty in the dollar. This week we saw a week where GoNoGo Trend painted mostly “NoGo” bars. However, as the week came to a close, we saw an amber “Go Fish” bar. Uncertainty book ends the few “NoGo” bars we saw in between. GoNoGo Oscillator is rising toward the zero line on heavy volume. We will watch to see if it stays in negative territory or if it can attack the zero line.

The weekly chart looks much the same as it did last week. The “Go” trend is hanging on and price is at levels that are above what should be strong support. GoNoGo Trend is painting weaker aqua “Go” bars after price fell from the last Go Countertrend Correction Icon. GoNoGo Oscillator is at zero, where we will watch to see if it finds support.