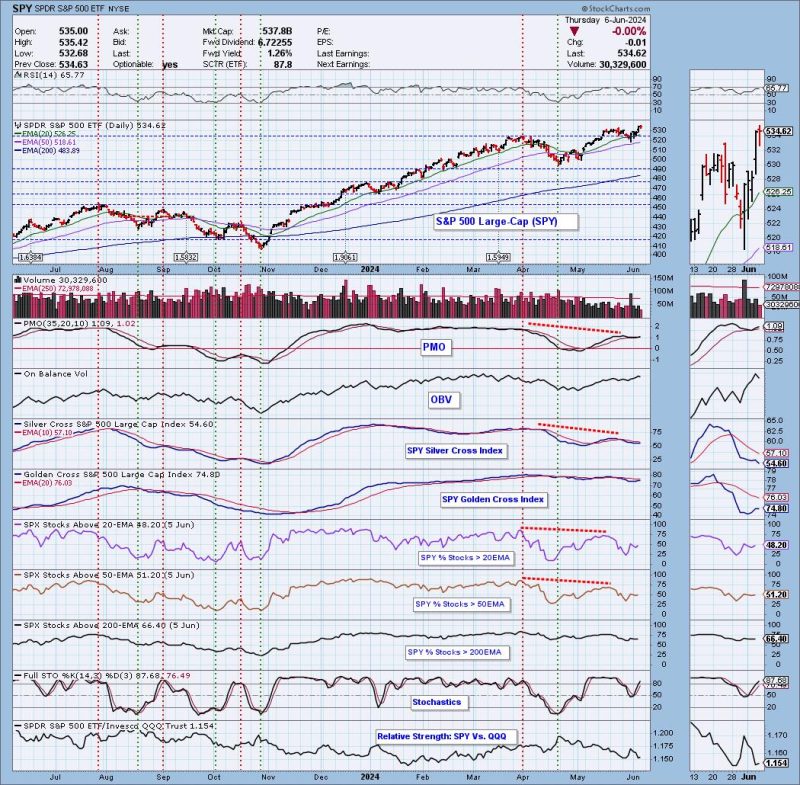

The Technology Sector (XLK) continues to dominate and drive the rally, but fewer and fewer stocks within the sector are participating in the rally. We know this because our Silver Cross Index (SCI), which shows the percent of stocks in the Technology Sector with Silver Cross BUY Signals (20-day EMA is above the 50-day EMA), is only at 54.60%. Almost half of the stocks are not on BUY Signals.

Further, looking at the seven years of data we have on the SCI (chart below), we were unable to find another case where XLK was making all-time highs with a Silver Cross Index reading so low that didn’t lead to price weakness. Of course, we owe this dislocation to the magic of cap-weighting. While fewer and fewer Technology stocks are participating in the rally, the mega-cap stocks are the ones making new highs, and driving up the price of every price index of which they are a component. The numerous negative divergences we can see are telling us that this probably won’t continue for long.

Conclusion: Participation within the Technology Sector has been fading since the beginning of the year. Mega-cap stocks are keeping prices elevated for now, but that probably won’t last.

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)