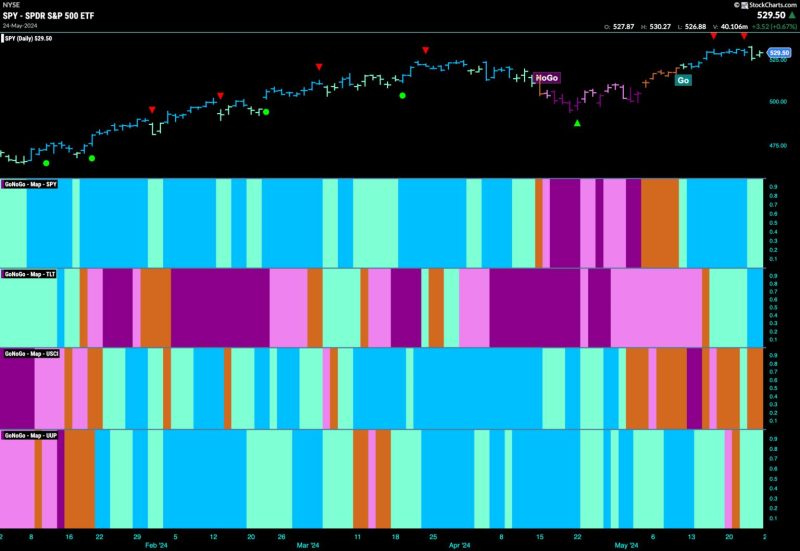

Good morning and welcome to this week’s Flight Path. We saw some weakness this week as price pulled back a little from all time highs. Momentum cooled, we saw this in the form of Go Countertrend Correction Icons (red arrows) and GoNoGo Trend painted weaker aqua bars. Treasury bond prices gained strength and painted blue bars. U.S. commodity index continued to show market uncertainty and the dollar regained “Go” colors albeit weaker aqua.

$SPY Shows Investors Digesting Gains

The “Go” remained this week but prices cooled as the market absorbed the gains we’ve seen over the past few weeks. As the week of trading came to a close, we saw weakness as GoNoGo Trend painted a couple of aqua bars. We will now turn out eye to the oscillator panel and watch as GoNoGo Oscillator approaches the zero line. We will look to see if it finds support at this level and bounces back into positive territory. If it does, we will see Go Trend Continuation (green circle) and can expect price to make an attack on a new higher high.

The larger weekly chart shows that the larger picture remains extremely bullish with another strong blue bar painted and price at all time highs. GoNoGo Oscillator is in positive territory but not yet overbought after having found support at the zero level.

Treasury Rates Flash “Go Fish” Bars

GoNoGo Trend was unable to continue painting amber “Go Fish” bars as last week came to an end. As prices rallied from the most recent low, the indicator rolled out of “NoGo” colors and painted a couple of uncertain “Go Fish” bars. It will be important to note now in which direction the trend goes next. If it falls back into “NoGo” bars that could be a positive for stocks, if it transitions from amber to “Go” colors that could pose a problem. GoNoGo Oscillator is riding the zero line where we see the beginnings of a GoNoGo Squeeze building. The direction of the Squeeze break will likely determine price’s next trend.

Dollar Recaptures “Go” Trend

After a brief flirtation with a “NoGo” and a “Go Fish” bar, the dollar was able to regain “Go” colors albeit weaker aqua ones. This is an inflection point for the dollar, as we can see that GoNoGo Oscillator is back testing the zero line from below. The oscillator has been in negative territory for a few weeks now, so if the “Go” trend is to survive, it will need to break back into positive territory. If it does, we will likely see the “Go” trend strengthen. If it is rejected again at the zero level, then we will expect further struggles for price.

The weekly chart continues to show us how important these levels are. With price now trying hard to find support at prior high levels from over a year ago, GoNoGo Oscillator has crashed back to the zero line. We will watch to see if it finds support here. If it does, we will see a Go Trend Continuation Icon (green circle) under the price bar as an oscillator bounce back into positive territory will tell us that momentum is resurgent in the direction of the underlying “Go” trend.