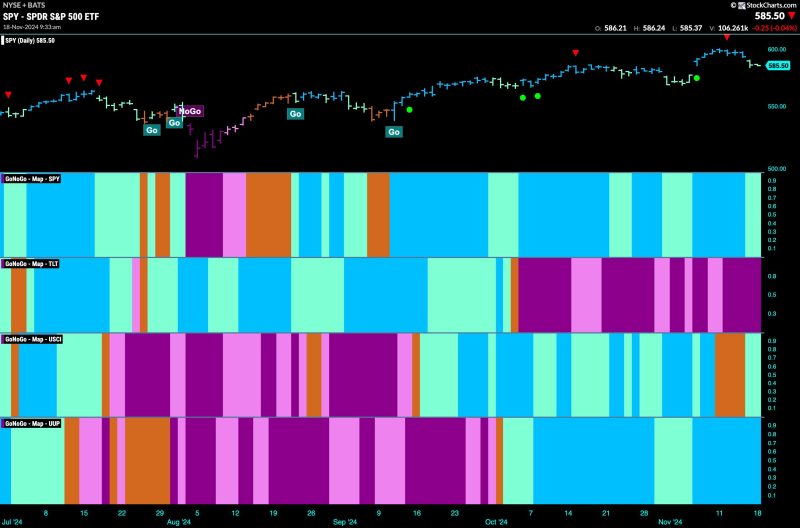

Good morning and welcome to this week’s Flight Path. Equities saw the “Go” trend continue this week but we saw weaker aqua bars at the end of the week. Treasury bond prices painted strong purple “NoGo” bars as the weight of the evidence suggested the “NoGo” will continue. U.S. commodities painted aqua “Go” bars after flirting with amber “Go Fish” bars of uncertainty last week. The dollar showed no weakness this week with an uninterrupted string of bright blue “Go” bars.

$SPY Paints Weaker “Go” Bars after High

The GoNoGo chart below shows that after hitting a new higher high on strong blue “Go” bars we saw a Go Countertrend Correction Icon (red arrow) signaling that price may struggle to go higher in the short term. Indeed, price fell in the following days, and GoNoGo Trend has painted weaker aqua bars. We will watch to see if price finds support at last month’s high. GoNoGo Oscillator also has fallen to test the zero line from above and we will watch to see if it finds support here as well. If the oscillator rallies back into positive territory we will look for price to make an attempt at another higher high.

A Go Countertrend Correction Icon (red arrow) has showed itself on the weekly chart after last week saw price fall into the end of the week. GoNoGo oscillator is in positive territory at a value of 3 and so no longer overbought. We will watch to see if it falls toward the zero line from here and if it does we will monitor for signs of support. GoNoGo Trend is painting strong blue “Go” bars as momentum remains positive confirming the direction of the trend.

Treasury Rates See Continued Strength

Treasury bond yields saw the “Go” trend continue this week and after a couple of weaker aqua bars the indicator showed a return to strength with bright blue bars all week as price rallied to challenge for new highs. GoNoGo Oscillator was perhaps responsible for the rally as we saw it bounce of the zero line into positive territory at the beginning of the week. Now, with GoNoGo Trend painting strong blue bars the oscillator is in positive territory at a value of 2.

The Dollar Remains at Elevated Levels

A week of strength propelled price to new highs again this week as GoNoGo Trend painted a string of unbroken bright blue “Go” bars. We are seeing a Go Countertrend Correction icon (red arrow) on the current bar as there is some waning momentum finally. GoNoGo Oscillator has fallen out of overbought territory and is approaching the zero line. We will watch to see if it finds support as and when it gets there. If it rallies quickly back into positive territory we will see that as a sign of trend continuation for the greenback.