Healthcare Re-Enters the Top 5

After a wild week in the markets, the sector ranking got quite a shake-up. Although only one sector changed in the top 5, the entire top 5 changed positions. In the bottom half of the ranking, only two sectors remained stationary.

The Healthcare sector re-entered the top 5 after dropping out two weeks earlier. This happened at the expense of Energy, which dropped to #7. Consumer Staples jumped from the #4 position and is now leading, followed by Utilities. Financials and Communication Services dropped to #4 and #5, down from #1 and #2.

In the bottom half, Real-Estate jumped to #6 from #9. Energy, dropping from the top 5, is now at #7, and pushed Industrials and Consumer Discretionary down to #8 and #9.

Materials and Technology remain on positions #10 and #11.

- (4) Consumer Staples – (XLP)*

- (5) Utilities – (XLU)*

- (1) Financials – (XLF)*

- (2) Communication Services – (XLC)*

- (6) Healthcare – (XLV)*

- (9) Real-Estate – (XLRE)*

- (3) Energy – (XLE)*

- (7) Industrials – (XLI)*

- (8) Consumer Discretionary – (XLY)*

- (10) Materials – (XLB)

- (11) Technology – (XLK)

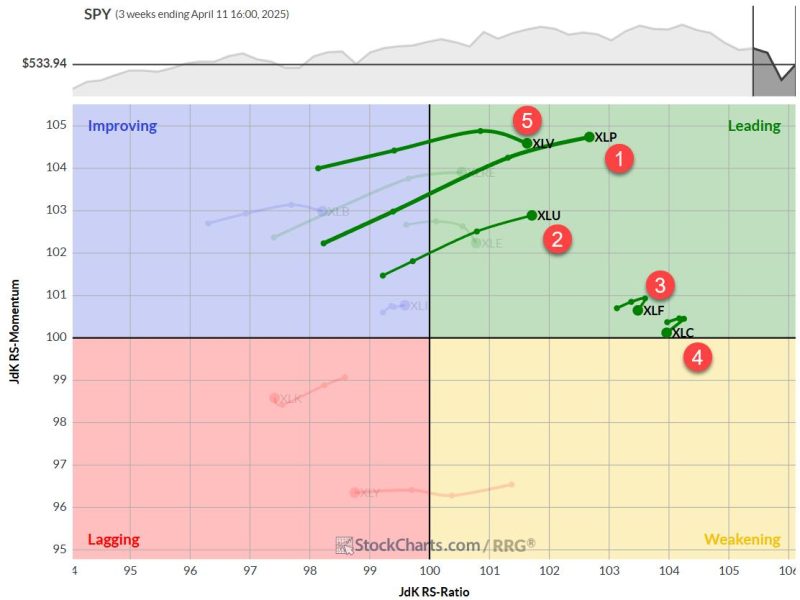

Weekly RRG: Strong Tails for XLU and XLP

On the weekly RRG, Financials and Communication services remain at high JdK RS-Ratio levels, but have started to roll over while still inside the leading quadrant.

XLV dropped on the JdK RS-Momentum axis, but is still moving higher on RS-Ratio. The two strongest tails are for XLP and XLU, which are pushing further into leading at positive RRG-Headings.

Daily RRG: Communication Services Drops into Lagging

On the daily RRG, XLP and XLU are starting to lose relative momentum, but it is happening at high RS-Ratio levels. This is combined with the strong weekly tails, which keep both sectors comfortably in the top 5.

XLV and XLF are rotating through the weekly quadrant, while XLC has crossed over into lagging.

Consumer Staples

XLP dipped back to support near 75, but recovered strongly back into its previous range. As a result, the raw RS-Line is challenging its overhead resistance, dragging both RRG-Lines sharply higher. This is now clearly the strongest sector.

Utilities

During the week, XLU dropped below support but managed to come back within the range at Friday’s close. Just like Staples, raw RS is about to break its upper boundary, away from its range. Both RRG-Lines are accelerating higher, pushing the tail deeper into leading.

Financials

XLF tested support around 42, but the bounce stopped near its old support level of around 47.50. RS has steadily moved higher within the boundaries of its rising channel.

Communication Services

A big price drop was caught just above horizontal support near 83. The recovery, so far, has not reached overhead resistance at 95, the old support level. This makes XLC the most vulnerable sector inside the top 5. Relative strength remains stable at high RS-Ratio readings and flat RS-Momentum.

Healthcare

The Healthcare sector re-entered the top 5 after one week of absence. This brings all three defensive sectors back into the RRG portfolio. On the price chart, XLV is battling with the former horizontal support area, now resistance, around 136. Relative strength continues to rise, putting the XLV tail well inside the leading quadrant.

Portfolio Performance Update

Last week’s volatility was a bit too much for the portfolio to keep up with, and it is now lagging the S&P 500 by almost 2%.

#StayAlert –Julius