Let us be honest: When most people hear ‘tariffs,’ they think about price hikes and trade wars. But the Trump administration’s latest tariff rollout is not merely a knee-jerk protectionist move—it is part of a far broader strategy.

What is actually in play here is a high-stakes effort to build up leverage and resources to manage America’s debt, reset its industrial base, and renegotiate its standing in the global order.

And it all begins with a problem most people have not been told enough about.

In 2025, the U.S. government must refinance $9.2 trillion in maturing debt. Some $6.5 trillion of that comes due by June. That is not a typo—that is a debt wall the size of a small continent.

Now, here is the math: According to Treasury Secretary Scott Bessent, each basis-point (one one-hundredth of a percent) drop in interest rates saves the government roughly $1 billion per year. Since the announcement of tariffs on April 2, 10-year Treasury yields have fallen from 4.2 percent to 3.9 percent—a 30 basis point drop. If that holds, it translates to $30 billion in savings.

So, keeping yields low is not just sound policy—it is a fiscal necessity.

But we are in a difficult environment. Inflation has not fully cooled, and the Federal Reserve remains wary of cutting rates too quickly. So the question becomes: How does one bring yields down without the Fed’s help?

Here is where the strategy becomes interesting.

By introducing sweeping tariffs, the administration is creating precisely the kind of economic uncertainty that drives investors toward safer assets such as long-term U.S. Treasuries. When markets are spooked, capital exits risk and equity assets (as we see with the stock market collapse) and piles into safe assets, primarily the 10-year U.S. treasury bond. That demand pushes yields lower.

It is a counter-intuitive move, but a calculated one. Some have called it a ‘detox’ for the overheated financial system. And it appears to be working.

However, even cheaper debt does not solve everything. The deficit remains massive—and that is where spending cuts come in.

Backed by the Department of Government Efficiency (DOGE) and Elon Musk, the administration is reportedly targeting $4 billion in daily spending cuts. If their recommendations translate to cuts and get ratified by Congress, that could amount to a trillion dollars off the deficit by late 2025.

At this point, we have two pillars: lower borrowing costs and tighter spending. But there remains a third—and arguably most important—pillar: growth.

Tariffs serve as the ignition switch. By making imports more expensive, they create space for American producers to step back in. The objective is not to punish trade partners—it is to make domestic industry viable again, even if only long enough to rebuild critical capacity.

Yes, prices will rise. But the administration is fully aware of that. In fact, it is front-loading the pain now, hoping to deliver visible job growth and factory activity before the November 2026 midterm elections.

In the meantime, tariffs themselves will generate revenue—an estimated $700 billion or more in the first year. That creates more fiscal room for the administration to enable tax cuts and keep spending on Social Security, Medicaid and other programs.

Where the picture becomes even more interesting is on the geopolitical front.

These tariffs do not exist in a vacuum. They are being deployed alongside a deliberate reshaping of global alliances. The U.S. is quietly distancing itself from NATO, recalibrating ties with Europe, and opening previously frozen diplomatic channels with the Gulf nations and Russia.

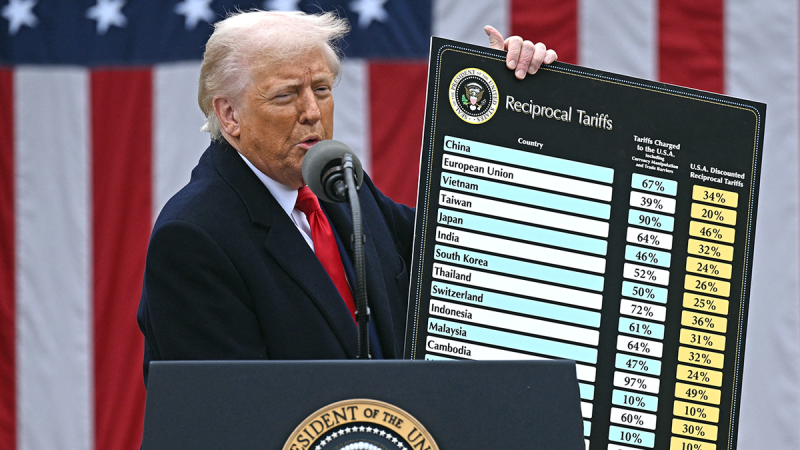

Why? Because the post-Cold War trade order no longer serves U.S. interests. It enabled deficits, offshoring, and strategic dependency. Now, tariffs become leverage. Allies who align with U.S. priorities receive relief; others face higher costs.

China, naturally, is the central player. For years, economists have argued that its artificially weak currency and industrial overcapacity have distorted global trade. Tariffs are one way to force a reckoning—and potentially, a revaluation of the yuan.

Other countries will not be spared. Europe could be asked for terms on Ukraine. India may be pressured for deep tariff cuts. Canada and Mexico will likely face demands related to fentanyl and border enforcement.

This is not random. It is trade policy as a means to force countries to the negotiating table.

Domestically, the political logic is equally clear. The sectors most likely to benefit—steel, automobiles, textiles—are concentrated in battleground states. The administration is betting that visible wins in those regions will outweigh short-term pain in sectors dependent on cheap imports.

There are serious risks here. If inflation returns or if the reshoring bet fails, the blowback could be severe. But make no mistake: This is not improvisation. It is disruption by design.

Whether one agrees with it or not, this is one of the most ambitious fiscal and industrial resets in a generation.

The only question that remains is—will it work?