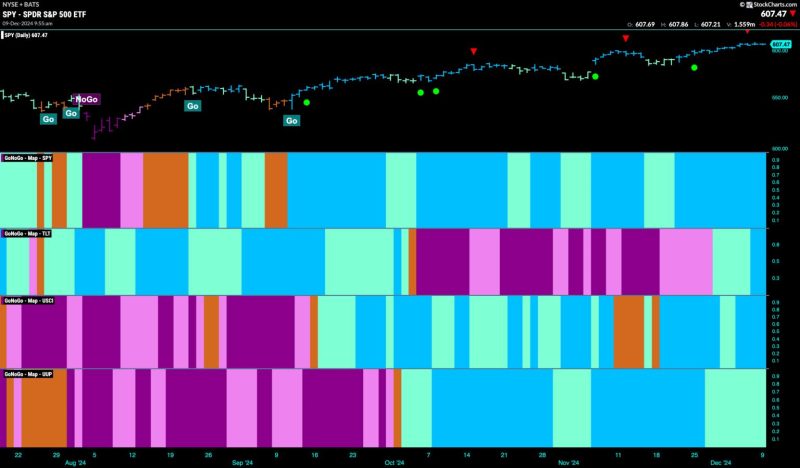

Good morning and welcome to this week’s Flight Path. The “Go” trend in equities continued again this past week and we saw a full week of uninterrupted bright blue bars. Treasury bond prices painted “Go” bars and the week ended with strong blue bars. U.S. commodities also remained in a “Go” trend with the indicator painting strong blue bars. The dollar likewise was able to hold on to its trend but we saw a string of weaker aqua “Go” bars this week.

$SPY Sees Another Strong week of “Go” bars

The GoNoGo chart below shows that price continued to rally this week as the indicator painted nothing but strong blue “Go” bars again. We do see a Go Countertrend Correction Icon (red arrow) at the most recent high which warns us that price may struggle to go higher in the short term. We see that GoNoGo Oscillator has fallen out of overbought territory and is now resting at a value of 4. There is still therefore strong momentum that is confirming the underlying “Go” trend.

On the longer term chart, the trend continues to be strong. Last week saw another higher weekly close albeit on a smaller bar. We will watch to see if price can edge higher again this week. The oscillator panel shows that momentum has been able to remain positive for several months now. It is currently at a value of 5. If momentum wanes, we will look to see if it finds support at the zero level again.

Treasury Rates Fall out of the “Go” Trend

Treasury bond yields completed the transition from a weaker “Go” to strong “NoGo” bars this week. With a couple of amber “Go Fish” bars that expressed uncertainty we can see that the “NoGo” took hold first with a pink bar. This came after GoNoGo Oscillator suggested as much when it failed to find support at the zero line just over a week ago. Now we see that momentum is negative at a value of -3 and confirms the new “NoGo” trend in price.

The Dollar Still Rests in “Go” Trend

We saw the dollar spend another week moving sideways this week and GoNoGo Trend painted a string of weaker aqua “Go” bars. We turn our eye to the lower panel and we can see that GoNoGo Oscillator has failed to find support at zero after having been stuck there for several bars. The Oscillator has now broken out of a GoNoGo Squeeze into negative territory which tells us that momentum is out of line with the “Go” trend. We will watch to see if this leads to further price deterioration.