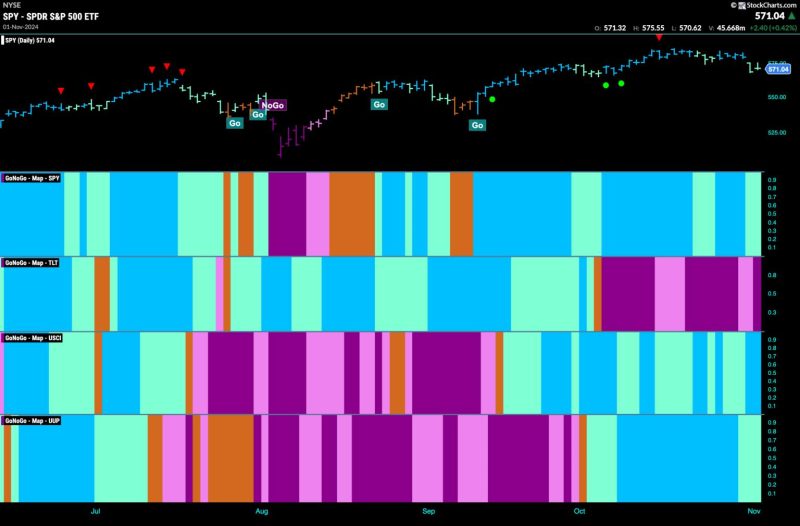

Good morning and welcome to this week’s Flight Path. Equities saw the “Go” trend remain in place this week but we saw weakness with a few aqua bars. GoNoGo Trend shows that the “NoGo” trend strengthened at the end of the week in treasury bond prices. U.S. commodities hung on to the “Go” trend and indeed we saw strength with bright blue bars. The U.S. dollar also remained in a “Go” trend but the indicator paints weakness with aqua bars.

$SPY Shows Weakness with a Pair of Aqua Bars

The GoNoGo chart below shows that we still have been unable to conquer the high from last month. This week saw price gap lower and weaker aqua bars return as price fell further. If we turn our attention to the oscillator panel we can see that after holding at the zero level for a few bars we have broken down into negative territory and volume has increased. We will watch closely to see if this further threatens the “Go” trend that is currently in place.

The longer time frame chart tells us that the trend remains strong but we see another lower weekly close this week after the Go Countertrend Correction Icon (red arrow) we recently noted above price. As price approaches the last high from the summer we will watch to see if it finds support. GoNoGo Oscillator is falling but still in positive territory so we will pay attention to what happens as it gets closer to the zero line.

Treasury Rates Remain in Strong “Go” Trend

Treasury bond yields saw the “Go” trend continue this week and after a couple of weaker aqua bars the week closed with strong blue “Go” colors after price made another higher high this week. GoNoGo Oscillator shows that momentum is still in positive territory but no longer overbought as it falls to a value of 3. We will look for support at the zero level if and when it gets there.

The Dollar Sees Weakness in “Go” Trend

We saw another Go Countertrend Correction Icon (red arrow) this week right after price made a new high. Since then we have seen consecutive aqua bars that demonstrate some trend weakness. Price rebounded on Friday with a strong bar and so we will watch to see if the trend will strengthen as it approaches prior highs. GoNoGo Oscillator fell sharply but turned around at a value of 1 and so is now rising at a value of 3 confirming the “Go” trend in the price panel.