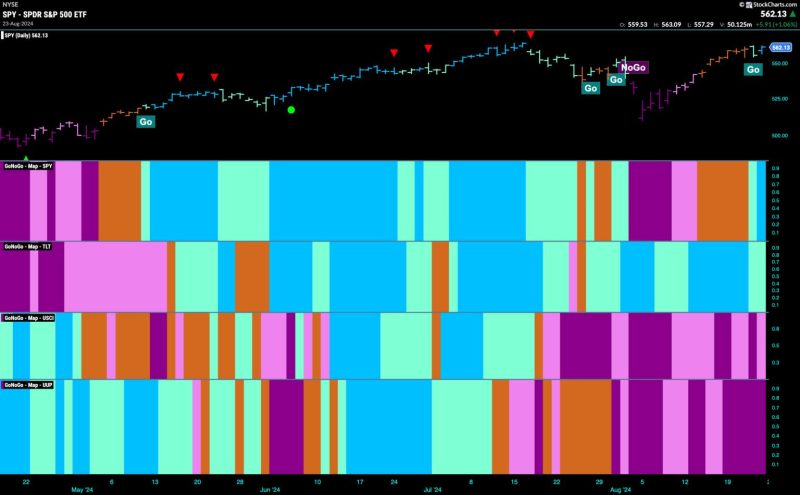

Good morning and welcome to this week’s Flight Path. Equities continue their path out of the “NoGo” correction. The “Go” trend has returned for U.S. equities as we see first an aqua and then a blue “Go” bar. This came after a string of uncertain amber “Go Fish” bars. Treasury bond prices remained in a “Go” trend albeit painting weaker aqua bars at the end of the week. U.S. commodities stayed in a “NoGo” painting weaker pink bars and the dollar showed strong purple “NoGo” bars.

$SPY Continues to Rally and Flags “Go” Trend

The week finished strongly as we saw GoNoGo Trend paint a bright blue “Go” bar as prices rallied after a challenging Thursday. We now see that momentum is in positive territory but not yet overbought and we will watch to see if price can mount an attack on a new high over the coming days and weeks.

The longer time frame chart shows that the trend is strong. At the last high we saw a Go Countertrend Correction Icon (red arrow) that indicated prices may struggle to go higher in the short term. Indeed, we then saw consecutive lower weekly closes on pale aqua bars. During this time, GoNoGo Oscillator fell to test the zero line from above and it became important to see if it could find support at that level. It did, and as it bounced back into positive territory we saw a Go Trend Continuation Icon (green circle) under the price bar.

Treasury Prices Remain in Strong “NoGo”

Treasury bond prices remained in a “NoGo” trend this week with the indicator painting strong purple bars. We see that although we haven’t seen a new low we have seen consecutive lower highs in the last few weeks. GoNoGo Oscillator is testing the zero line from below once again and we will watch to see if gets rejected here or if it is able to break through into positive territory.

The Dollar’s “NoGo” Shows Renewed Strength

A strong message sent this week for the U.S. dollar. A string of purple “NoGo” bars took prices to new lows. GoNoGo Oscillator is back in oversold territory after briefly trying to move back toward neutral territory. Volume is heavy, showing strong market participation in this most recent move lower.

USO Stays in “NoGo” Trend

Price moved lower all week on strong purple bars. We didn’t see a new low though and on Friday price gapped higher and GoNoGo Trend painted a weaker pink bar. GoNoGo Oscillator is back testing the zero level from below where we will watch to see if it finds resistance. If it does, we can expect further downside pressure on price. If it is able to regain positive territory we may well see price try to rally out of the “NoGo”.