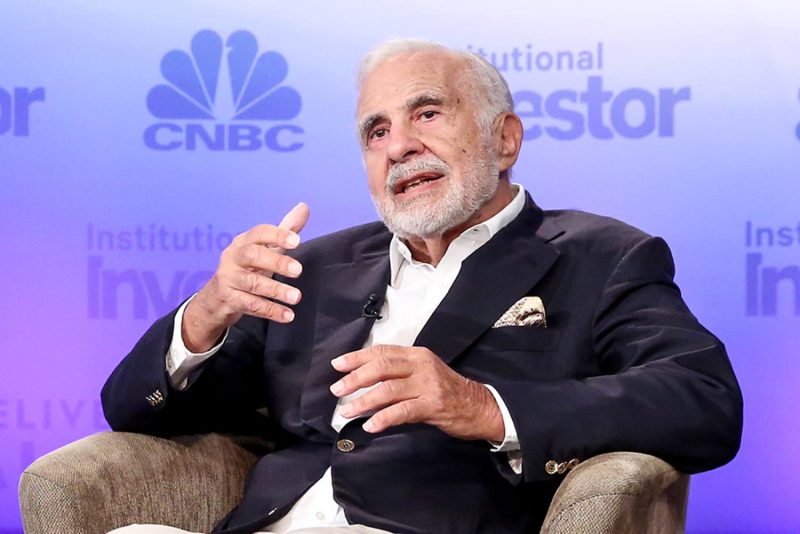

The Securities and Exchange Commission on Monday said it fined billionaire activist investor Carl Icahn and his company $2 million, settling allegations that he failed to disclose billions of dollars worth of personal margin loans pledged against the value of his Icahn Enterprises stock.

Icahn and the publicly-traded company that bears his name settled those charges without admitting or denying wrongdoing. They agreed to pay $500,000 and $1.5 million in fines, respectively, the SEC said in a press release Monday.

The SEC said that Icahn, who established himself as a ruthless corporate raider before adopting the friendlier mantle of activist investor, pledged anywhere from 51% to 82% of Icahn Enterprises, or IELP, shares outstanding to secure billions worth in margin loans without disclosing that fact to shareholders or federal regulators.

Icahn’s cumulative personal borrowing was as much as $5 billion, according to an SEC consent order.

As the effective controlling shareholder of IEP, Icahn would have been expected to make what are known as Schedule 13D filings, which typically detail what a controlling shareholder expects to do with their influence over a company. They also would have had to include information about any encumbrances, like margin loans, on a stake.

“The federal securities laws imposed independent disclosure obligations on both Icahn and IEP,” Osman Nawaz, a senior SEC official, said. “These disclosures would have revealed that Icahn pledged over half of IEP’s outstanding shares at any given time.”

Icahn’s margin borrowing was highlighted in a May 2023 report issued by short-seller Hindenburg Research, which put pressure on Icahn Enterprises’ stock after alleging that the holding company was, among other things, not estimating the value of its holdings correctly.

Icahn amended, consolidated and disclosed his margin borrowings in July, according to the SEC’s consent order, two months after the Hindenburg report.

“The government investigation that followed has resulted in this settlement which makes no claim IEP or I inflated NAV or engaged in a ‘Ponzi-like’ structure,” Icahn said in a statement to CNBC. “We are glad to put this matter behind us and will continue to focus on operating the business for the benefit of unit holders.”

Hindenburg Research wrote on X on Monday that IEP is “still operating a ponzi-like structure” and reiterated that it remains short the stock.