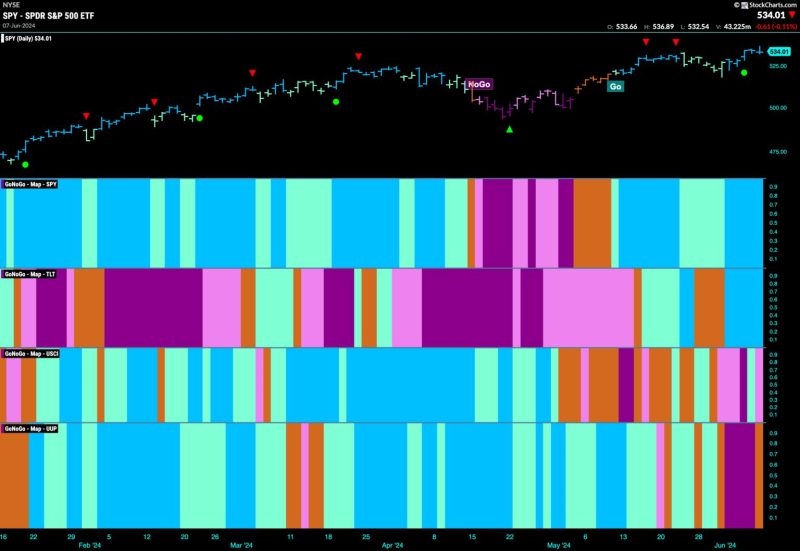

Good morning and welcome to this week’s Flight Path. Equities rebounded this week as we saw a string of strong blue “Go” bars and price hit a new higher high. Treasury bond prices returned to a “Go” trend with their own week of strong blue bars. Commodities struggled again as GoNoGo Trend was unable to maintain “Go” colors. The dollar shows uncertainty at the end of the week with an amber “Go Fish” bar.

$SPY Paints Strong Blue “Go” Bars at All Time Highs

After the weakness we saw the week before, GoNoGo Trend shows that the strength in the “Go” trend returned this week as we saw a run of bright blue bars and price made a new higher high. This came with signs of trend continuation as GoNoGo Oscillator broke out of a GoNoGo Squeeze into positive territory. This tells us that momentum is resurgent in the direction of the “Go” trend.

The larger weekly chart shows that the “Go” trend continues to be strong with another bright blue bar and a higher weekly close. GoNoGo Oscillator is now back in overbought territory at a value of 5 and this shows market enthusiasm in the “Go” trend.

Treasury Rates Remain in “NoGo”

GoNoGo Trend painted strong purple “NoGo” bars for much of this week even in the face of a strong final bar. This week saw a new lower low as the “NoGo” trend was strong. GoNoGo Oscillator is in negative territory but not oversold. Friday’s strong bar saw the oscillator turn up and so we will watch to see if it finds resistance at the zero line in this “NoGo” trend.

Dollar Shows Uncertainty with “Go Fish” Bar

This week saw a “NoGo” take over the greenback for much of the week. However, on Friday, GoNoGo Trend painted an amber “Go Fish” bar and so we will watch to see in which direction the trend goes this week. As price jumped higher to paint the amber bar, GoNoGo Oscillator reversed course sharply from moving lower in negative territory to a value of +1. We will be interested to see if the oscillator remains in positive territory or if it retests the zero line right away.