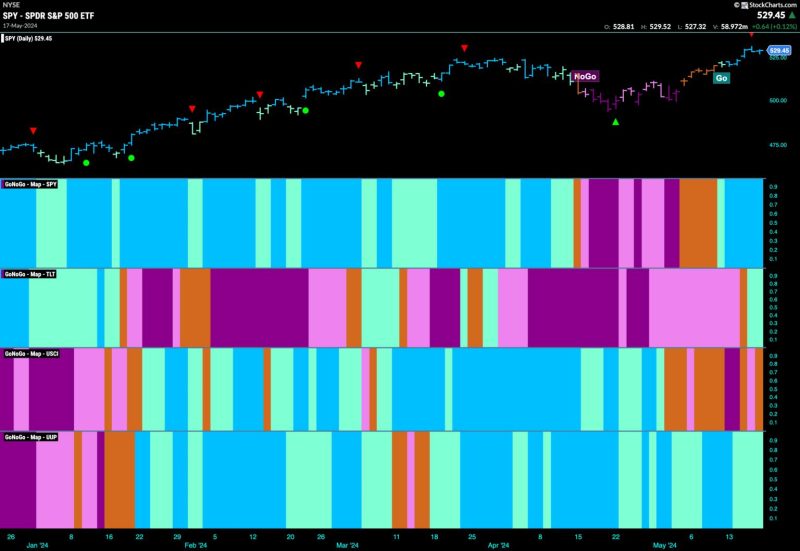

Good morning and welcome to this week’s Flight Path. The “Go” trend in equities is well and truly back as we saw a string of uninterrupted blue bars this week and price hit a new all time high. Treasury bond prices entered a weak “Go” trend which is perhaps bad news for rates as we’ll see in a moment due to the inverse relationship. The U.S. commodity index continued to show market uncertainty as it ended the week with another amber “Go Fish” bar. The dollar maintained its “Go” trend but we saw some weakness as this week GoNoGo Trend painted a majority of aqua bars.

$SPY Hits New All Time Highs

The “Go” trend we spied last week really took off this week as we saw a week of uninterrupted strong blue bars and price high all time highs midweek. GoNoGo Oscillator fell out of overbought territory and that caused a Go Countertrend Correction Icon to appear on the chart which tells us price may struggle to go higher in the short term. Now at a value of 4, momentum is positive and in the direction of the underlying “Go” trend. We will look for price to find support and consolidate above prior highs.

The larger weekly chart shows that after several weeks of pullback, coming after the Go Countertrend Correction Icon that we saw over a month ago, the trend has once again strengthened as GoNoGo Trend once again paints strong blue bars. GoNoGo Oscillator bounced sharply off the zero line which helped confirm the “Go” trend and with momentum resurgent in the direction of the “Go” trend we saw price hit a new high this week.

Rates Enter “NoGo”

GoNoGo Trend saw the weakness we noted last week turn into a new “NoGo” trend. After GoNoGo oscillator entered negative territory a couple of weeks ago we could infer that the “Go” trend was no longer healthy. After a long run of weaker aqua “Go” bars we saw the trend give way this week and a mix of pink and purple “NoGo” bars. Now, with GoNoGo Oscillator approaching the zero line from below, we will watch to see if this trend can hold.

Dollar Remains in “Go” but Struggles

The”Go” trend remained in place this week but we saw a majority of weaker aqua bars as price made a new lower low. GoNoGo Oscillator has been rejected by the zero line twice since first crossing into negative territory and now is steadily falling. This is a concern for the “Go” trend in this periodicity and we will watch to see if this week brings a change in technical environment.