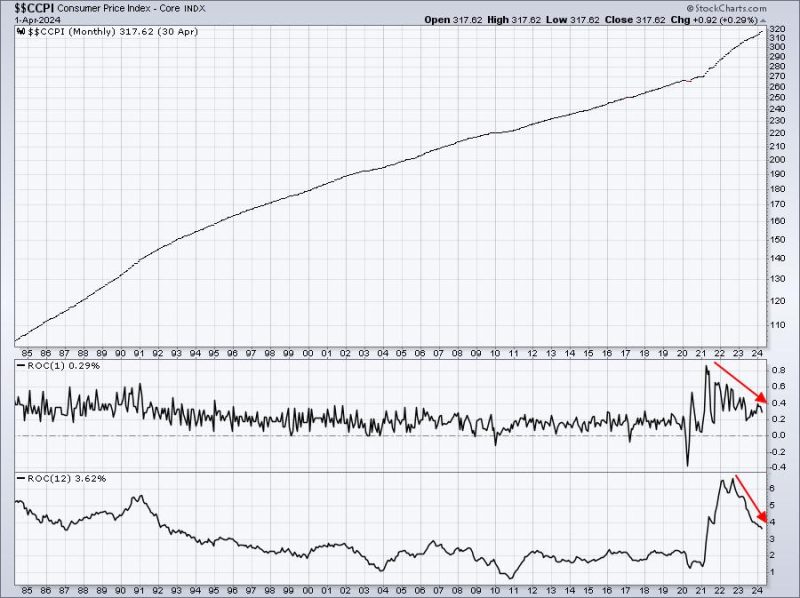

Last week’s rally to record highs was due, at least in part, to a rather tame CPI report released on Wednesday. Inflation has been at the heart of nearly every rally and every decline over the past few years. Clearly, we saw inflation soaring throughout 2021 and 2022, but since then, the annual core CPI has been consistently dropping, despite a Fed that says they haven’t seen enough of a drop toward their 2% target level to warrant a fed funds rate decrease. Here’s the Core CPI chart that illustrates the rise and fall of inflation since the 2020 pandemic began:

Call me crazy, but I see an annual Core CPI rate that is tumbling. History tells us that when inflation peaks and rolls over, it’s a very bullish signal for U.S. equities. 2023 and 2024 has been no different. However, there is one inflation problem that no one is really talking about.

Inflation Likely To Climb This Summer

There’s like to be a few negative/bearish analyst comments this summer. The reason? In 2023, the June (+0.19%), July (+0.23%), and August (+0.23%) represented the 3 lowest monthly core CPI readings. That means that these monthly readings in the same 3 months as 2023 will need to come in extremely low or there’ll be brief 3-month spike in the annual core rate of inflation at the consumer level. We know the stock market doesn’t like uncertainty of any kind and a 3-month move higher in inflation could trigger that uncertainty.

Keep in mind that the June, July, and August readings are generally reported within the first 10 days to 2 weeks of the following month. So if we see weakness from these readings, it’ll likely be from mid-July through mid-September.

Presidential Election Year Cycle

Finally, let’s review the typical price action during a Presidential election year:

During this cycle, we tend to see very strong runs to the upside in late-May, June, and into early July. Given that our major indices just broke to new all-time record highs after a period of consolidation, this potential bullish scenario looks like a solid one to me.

But when those June, July, and August CPI readings come out, just think back to this article. This could be a real threat to our major indices over the late summer months.

I spoke, in much more detail, about this possible inflation scenario unfolding later this year during my “EB Weekly Market Recap” video at YouTube.com. Be sure to check it out and hit the “Like” button. If you haven’t already done so, be sure to “Subscribe” to our YouTube channel as well, so that you don’t miss future EB.com videos!

Spring Special Has Begun!

Our absolute best membership deal of the year started last week. If you’d like to check out our service and save A LOT of money simultaneously, please CLICK HERE for more information on the deal.

Happy trading!

Tom