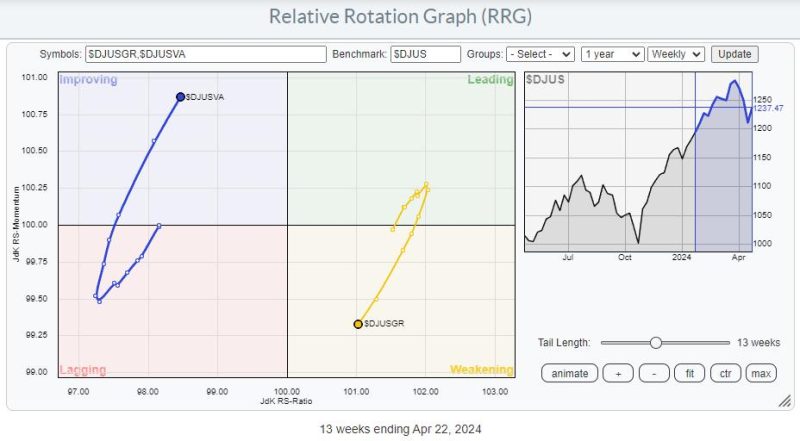

Value taking the lead from growth

The weekly RRG above shows the rotation for Growth vs Value stocks. The benchmark is the DJ US index. The recent rotation clearly shows the rotation out of growth into value, taking shape and picking up steam. For now, Growth is still positioned on the right-hand side of the RRG, but the $DJUSGR tail is rapidly heading toward the lagging quadrant at a negative RRG-Heading.

The daily version of this RRG underscores the preference for Value stocks.

The $DJUSVA tail dropped into the weakening quadrant after a rotation through leading since mid-March and sharply hooked back up after one day inside the lagging quadrant and is now returning into the leading quadrant, supporting a further strengthening for the Value tail on the weekly time-frame.

$SPX usually tracks the Growth/Value ratio pretty good

Plotting the Growth/Value ratio on top of the price chart for $SPX shows that they have tracked each other quite well over time. This is a monthly chart, so we’re discussing long-term trends here.

The main takeaway here is that the S&P usually does well when the growth/value ratio goes up and less well when the ratio moves lower.

With the RRG currently showing a strong preference for Value stocks, caution is warranted as this might be the precursor for a further decline in the S&P 500 itself.

The preference for value over growth shows up across all size segments

When we break down the Growth and Value segments into their respective size buckets, we get the RRG above. This shows that value beats growth across all size segments. Large-, Mid-, and Small-cap Value tails are all inside the improving quadrant and moving at a positive RRG-Heading.

The growth tails are slightly more divided, but all three are on a negative RRG-Heading, with large-cap growth showing the fastest deterioration. Mid-Cap is the most stable, with its short tail just inside the weakening quadrant. While small-cap growth stocks have rolled over inside the leading quadrant and are starting to head lower on both scales.

All in all, this underscores the need for caution regarding price developments for the S&P 500 in the coming weeks.

5%-10% downside risk within long-term uptrend

On the weekly chart, SPY found support at the level of the former rising resistance line at around 494. More important support is found at the level of the January-2022 peak at 480, and in case that breaks, the area around 460 will provide another solid support area. With the current longer-term trend of higher highs and higher lows still firmly in place, we have to conclude that the uptrend is still in play.

But at the same time, we have to realize that within that uptrend, a 5-10% decline is perfectly possible.

The more detailed daily chart of SPY shows that the decline from the recent peak at 524 back to the low near 495, which is one move lower on the weekly chart, is already showing lower highs and lower lows, which means that rallies now have to be seen as up-ticks within a downtrend until this structure changes again.

The green-shaded areas represent the support levels mentioned on the weekly chart. New buying opportunities within the long-term uptrend should start to arise in these ranges.

Rotation into defensive sectors confirms risk-off

Finally, the daily RRG for defensive sectors shows a rapid rotation into Health care, Consumer Staples, and Utilities in the last two weeks of trading, which confirms the need for caution in the coming weeks.

#StayAlert, –Julius