Shares of Trump Media plunged more than 13% on Monday after the company filed to issue millions of additional shares of stock.

Trump Media’s dramatic slide came as Donald Trump headed to a Manhattan court to begin jury selection for his criminal trial on hush money-related charges. Trump is the majority stakeholder in the company.

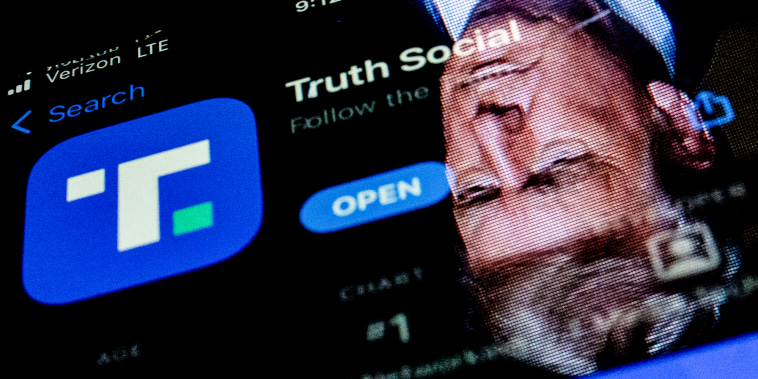

Trump Media, which created the Truth Social app and trades under the stock ticker DJT on the Nasdaq, fell nearly 20% last week.

The company’s intent to issue more common stock was made public Monday morning in a “preliminary prospectus” filed to the Securities and Exchange Commission. The shares cannot be issued until a registration statement with the SEC goes into effect.

The filing describes a plan to offer more than 21.4 million shares of common stock, issuable “upon the exercise of warrants,” the filing shows. Stock warrants give their holder the ability to buy shares at a predetermined price within a certain time frame.

Trump Media predicted in the filing that it will receive “up to an aggregate of approximately $247.1 million from the exercise of the Warrants.”

The closing price of Trump Media’s warrants was $13.69 as of Friday, according to the filing. The warrants are being traded on the Nasdaq under the ticker “DJTWW.” That ticker was down more than 8% before the market opened Monday.

The company also seeks to offer the resale of up to 146.1 million shares of stock from “selling securityholders,” 114.8 million of which are held by Trump himself. Trump owns 78.8 million shares of the company, and stands to obtain 36 million “earnout shares” if the stock stays above a certain price for enough trading days.

Trump’s current stake in the company was worth more than $2.2 billion at Monday morning’s share price. Trump is not allowed to sell his shares until a monthslong lockup period expires.

Trump, whose social media following was massively diminished after he switched to Truth Social following his suspension from Twitter and Facebook in 2021, has tried to encourage his followers to flock to the fledgling app. But it is unclear if they have heeded Trump’s call. The company has not publicly released key performance indicators, including the number of active Truth Social users.