Summary

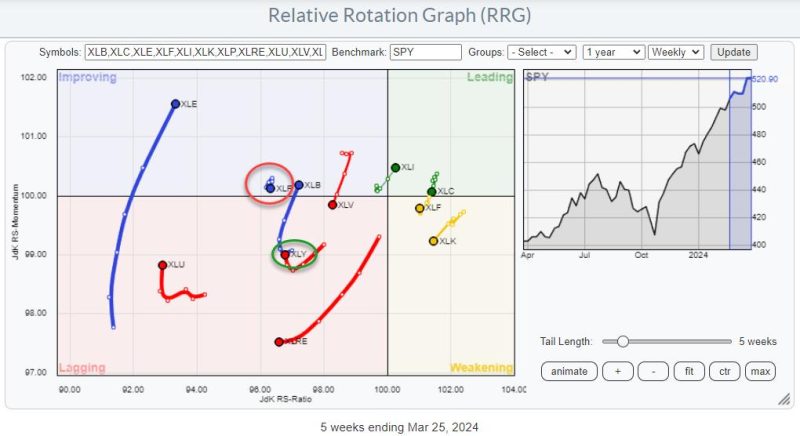

The Relative Rotation Graph for US Sectors for this week mainly shows a continuation of the rotations as they were underway last week.

XLB : Moving from lagging into improving at a strong RRG-Heading, underscoring the building up of relative strength for this sector.

XLC : Stable inside the leading quadrant on a short tail.

XLE : Adding a long new segment to the tail, pushing it further into the improving quadrant at the highest JdK RS-Momentum reading in the universe.

XLF : Inside the weakening quadrant but at a very short tail, indicating a stable relative uptrend that is going through a pause.

XLI : Pushing into the leading quadrant now at a strong RRG-Heading while moving away from the center (benchmark) of the chart. This suggests an improvement in relative strength.

XLK : This week, the tail is accelerating at a negative RRG, heading toward the lagging quadrant, urging (more) caution in the tech sector.

XLP : Remains stable, just above 100 on the JdK RS-Momentum scale on the left side of the RRG. Relative strength slowly drifting lower.

XLRE : The raw RS-line dropped below horizontal support, which will likely ignite a new acceleration lower, pushing the XLRE tail deeper into the lagging quadrant.

XLU : The tail picked up some relative momentum this week but no relative strength yet. This suggests it is more of a temporary move. This makes sense, as XLU has the lowest RS-Ratio reading in the universe.

XLV : The tail is crossing back into the lagging quadrant from improving. With the raw RS-Line dropping below horizontal support, more relative weakness is expected, pushing XLRE further into lagging.

XLY : Starting to improve slowly while inside the lagging quadrant. Not at a positive RRG-Heading yet

Discretionary beating Staples

One interesting observation that can be made from the RRG above is the Consumer Staples sector (XLP) slowly rotating out of favor while the Consumer Discretionary sector has started to pick up relative momentum inside the lagging quadrant and has now started to move back up.

When we zoom in on that relationship, using a daily RRG, it becomes visible that this rotation is now getting traction.

Let’s just say that discretionary beating staples in relative terms is NOT a characteristic of a bear market.

Sectors Pushing Against Major Resistance Levels

Another thing that caught my eye is that many sectors are pushing against or nearing major resistance levels. Including defensive sectors like Staples and Utilities, Healthcare has already broken higher.

It ain’t over until its over. When these sectors convincingly break their overhead resistance levels, they will likely provide new fuel to power the rally even further.

#StayAlert, –Julius